100% Online

Join the constantly innovating world of finance. Digital technologies are revolutionising accounting and finance and you can be part of it.

Undergraduate

Qualification

3 years full-time

Duration

Mar, July, Nov

Start Date

24

Units

100% Online

Learning Mode

$16,992*

Fees

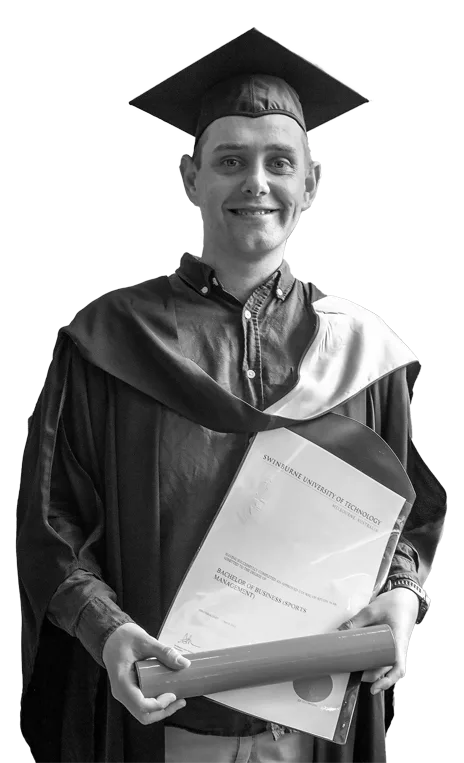

‘The flexibility to study at my own pace and my own time was perfect and allowed me to finish my degree in around 3 years, using every [teaching period] I could.’

Jacob, Swinburne Online graduate

As an Financial Planner, you’ll never go out of business. There’s an expected increase of 10.7% for financial planning jobs over the next 5 years.

The Business Faculty received a 5-star rating for overall quality of educational experience.

Taught by experienced financial professionals, this course will give you the tools to evaluate and communicate financial information to drive business outcomes. With a focus on the latest technology and sustainable investment, you’ll learn to help clients plan for investment, taxation, insurance, retirement and estate planning.

Throughout your studies, you’ll be exposed to the latest financial management software, such as XERO and XPLAN. You’ll do assessments designed to prepare you for the workforce, such as developing strategies for real-life clients. You’ll also undertake a financial planning project, where you will learn to make investment decisions and get insight into what it’s like to be a financial advisor.

Through the majors in both Accounting and Financial Planning, you will have the opportunity to fully understand business practices, software and strategies. Graduates will head into the workforce industry-ready with the knowledge needed to succeed.

Our industry consulting project with real-life clients, like Acrodyne, Build Pass, Epilepsy Foundation, Inception Point, Inclusion Melbourne and Lend For Good, will give you the confidence to hit the ground running when you graduate.

This course meets the educational requirements of the Financial Planning Association of Australia (FPA). It is also professionally accredited by CAANZ (Chartered Accountants Australia and New Zealand) as well as CPA (Certified Practising Accountants) Australia. In addition, it is ASIC approved qualification which forms part of the requirements to becoming a financial adviser, ensuring you’ll learn the skills necessary to enter the financial planning industry with confidence.

The suite of Swinburne Online Business degrees provides students with the opportunity to forge connections within the industry. Students hear from industry leaders and work with real-life clients with demonstrated experience within their respective fields, such as SEEK.

Fill in your details to receive detailed information regarding:

Studying at Swinburne Online gives you the freedom to study when, where and how you want to. Keeping your lifestyle in mind, we tailor your study journey to your own needs. Get a world-class degree without giving up what’s important to you.

Flexible study at Swinburne Online

Set your own study pace! Swinburne Online offers part-time and full-time study options to suit your busy lifestyle. Through our part-time studies, you can increase your unit load as you progress through your chosen course.

Interested in fast-tracking your studies? You also have the opportunity to complete up to 12 units per year.

You don’t have to put your life on hold to study. Prioritise what matters to you and fit study around family, work and personal commitments through a course that is flexibly designed for online learners.

Start your study journey when it suits you. Swinburne Online offers multiple intake dates and flexible unit availability. Choose when you begin your studies and when to take a break, if needed.

Flexible study requires flexible support. As a Swinburne Online student, you’ll have support for extended hours, 7 days a week, with Student Advisors available to help with anything from tech support to research advice. You will also have dedicated online tutors in each of your units.

Whether you’re looking to fast-track your studies or prefer a part-time study option, Swinburne Online degrees flexibly fit around your study needs.

Here’s an example of a study journey of a full-time student:

The Bachelor of Business – Accounting and Financial Planning consists of 24 units, including seven core business fundamental units, the choice of one of two core business practice units and 16 accounting and financial planning major units.

Capstone units combine the skills you’ll learn throughout your degree and apply them to practical scenarios to solidify your knowledge. You’ll collaborate with your peers and solve real business problems, giving you the confidence to step into the workforce with practical experience.

The Bachelor of Business – Accounting and Financial Planning is accredited by the following professional bodies:

The Bachelor of Business, with a Financial Planning major, is a Financial Adviser Standards (FAS) approved course, making it a recognised pathway towards becoming a registered financial planner.

Graduates will satisfy the education standards prescribed by FAS to be able to provide financial advice in Australia, subject to meeting other registration requirements prescribed by FAS (including completion of a Professional Year for Provisional Relevant Providers and passing a National Adviser Exam).

Graduates are eligible for entry into the Financial Planning Association of Australia’s CFP (CERTIFIED FINANCIAL PLANNER) certified program. Students who hold a Graduate Diploma in Financial Planning from Swinburne Online will receive recognised prior learning for CFP1 – 4, and will only need to complete the CFP Capstone unit to become a CFP.

Swinburne Online business degrees are accredited by the Association to Advance Collegiate Schools of Business (AACSB) International, and are a part of the five per cent of business schools worldwide accredited by AACSB. The alumni of AACSB accredited business schools are among the world’s most influential leaders, innovators, and entrepreneurs impacting business, government, and non-profit sectors.

Swinburne Online offers a unique, digital study environment that includes a dynamic virtual classroom environment and peer interaction on a custom-built social platform. You’ll also receive support at the times you need it most from Online Learning Advisors (OLAs) who understand the complexities of studying online.

With the guidance of OLAs that have real world experience in your field of study, you’ll complete each of your units in Canvas – your online classroom. Canvas is where you’ll access classes, assignments and discussion boards with your peers

The Student Hub is your online campus, where you’ll access the support and resources to assist you throughout your study journey. From managing your course to technical support and library resources, you’ll find it all in one easy location.

Swinburne Online will be there for you each step of the way. From enrolment through to graduation, we offer extended, flexible support in each of your units. Our OLAs are waiting to assist with anything from technical support to referencing and assignment tips.

Lecturer and Researcher

'At Swinburne, we see that rather than replacing accountants, technology can augment their accounting skills and supercharge their ability to create business value. Being a technology university, we draw on our technology research to equip future accountants with the technology knowledge and skills necessary for them play critical roles in their organisation’s digital transformation and digital business agendas.'

Completion or partial completion of an approved tertiary qualification (including diplomas, advanced diplomas, associate degrees and degrees). Additional performance criteria and prerequisite requirements may also apply.

Applicants without a formal qualification but with significant and relevant work experience and appropriate English language skills, or a suitable Special Tertiary Admissions Test (STAT) result, will be considered. All students need to demonstrate that they can undertake the course with a reasonable prospect of success.

Read our Applying and Enrolling FAQs.

The University may determine selection criteria and restrictions in respect of courses to apply in addition to these entry requirements.

Successful completion of the Victorian Certificate of Education (VCE) or its equivalent, such as an interstate or international Year 12 qualification. Minimum ATAR requirements may apply.

VCE prerequisites: Units 3 and 4: a minimum study score of 25 in English (or equivalent) or 30 in English (EAL).

Read our Applying and Enrolling FAQs.

Credit transfer

Credit is granted in recognition of previous study and/or experience and allows students to gain advanced standing towards their course. Applicants are assessed on a case-by-case basis. Speak to a Course Consultant about applying for credit.

Applicants who have completed a Diploma in a related discipline may be eligible for credit of up to 8 units; the equivalent of a third of the course. Students admitted to the course with prior tertiary studies that satisfy part of the academic requirements of this course may be eligible for academic credit of up to 16 units.

Recognition of Prior Learning

Recognition of Prior Learning (RPL) allows students to gain credit (advanced standing) towards their course in recognition of skills and knowledge gained through work experience, life experience and/or formal training. Applicants are assessed on a case-by-case basis. Speak to a Course Consultant about applying for RPL.

Pathways allow students to progress from one qualification to another where the first course is recognised as an entry requirement and provides advanced standing to the second.

Credit available may vary depending on the major selected within any given degree but in most instances you may receive up to 8 unit credits.

Our Course Consultants will step you through the process of entry and credit using previous study.

The estimated annual fee for this course is $16,992*. This is based on completing eight 12.5 credit point units in one calendar year.

*Unit fees are subject to change annually.

Commonwealth provided loans are available to assist eligible students to pay their course fees. There is a range of university, government and privately funded scholarships and prizes.

Discover more information about HELP loans.

Course fees will be affected by a student’s unit selection and any credit awarded in recognition of previous academic experience.

This course is offered to domestic and offshore international students. Depending on your citizenship, you may be eligible for a Commonwealth Supported Place.

Domestic students also contribute to student services and amenities via an annual fee.

Scholarships are available for both commencing and current students. You may be eligible for Swinburne Scholarships.

The Bachelor of Business with majors in both Accounting and Financial Planning prioritises your readiness to succeed come graduation through industry connections embedded in your degree:

Play a crucial role in supporting organisations to make informed financial decisions. You’ll be able to find ways to improve profitability, a key aspect of financial leadership.

Help clients manage their finances and give expert advice on financial reporting, forecasting and analysis.

Drive the future of your organisation – you’ll communicate your financial expertise to inform important decisions that will affect your company and its’ growth.

Take the reins and run the accounting and financial activities of an organisation. Ensure reporting requirements are met and provide timely and accurate information to the management team.

Oversee the day-to-day operations of your finance department. Through a strong analytical lens, you’ll lead the development and implementation of complex financial strategies.

Assist individuals and companies to reach their long-term financial goals. Provide expert advice on investing, retirement planning, superannuation and other key financial aspects of people’s lives.

Take a leadership role not just in project planning, but delivering the exciting results. You’ll be part of every process, from ideation to execution.

Swinburne business degrees are accredited by the Association to Advance Collegiate Schools of Business (AACSB) International, and are a part of the 5% of business schools worldwide accredited by AACSB. The alumni of AACSB accredited business schools are among the world’s most influential leaders, innovators, and entrepreneurs impacting business, government, and non-profit sectors.

Fill in your details to receive detailed information regarding:

Testimonial

‘Learning with Swinburne Online has been great as the technology they use is so fantastic and easy to navigate. You’re not just listening to someone showing a PowerPoint slide. There’s constant interaction between students and staff members. A key thing for me was being able to ask for help so that I could learn in the way that suited me.’

Genevieve

Swinburne Online graduate